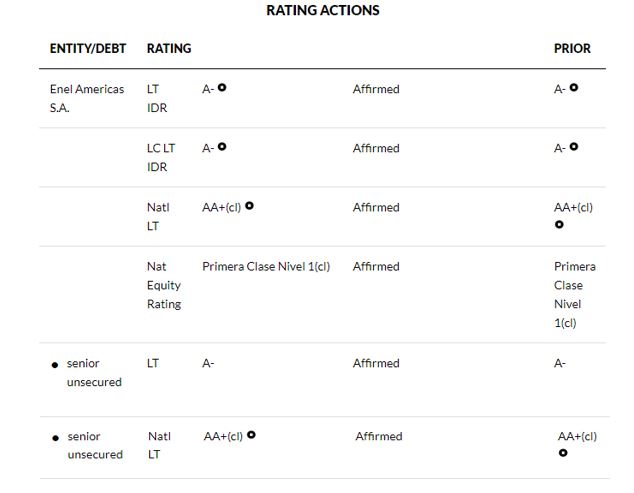

Fitch Ratings - New York - 05 Aug 2021: Fitch Ratings has affirmed Enel Americas S.A.'s Long-Term Foreign and Local Currency Issuer Default Ratings (IDRs) at 'A-' and Long-Term National Scale rating at 'AA+(cl)'. In addition, Fitch has affirmed the company's National Equity Rating at 'Primera Clase Nivel 1 (cl)'. The Rating Outlook is Stable.

The affirmation of Enel Americas reflects its strong track record of delivery on its objectives, its strong diversified and geographic footprint in South America and Central America, conservative leverage profile, strong relationship with parent Enel S.p.A (Enel Group, A-/Stable) and its focus on innovation and sustainability in the utilities sector in South America. The 'A-' rating also reflects the risks embedded in merchant activities, a strong focus on growth and shareholder remuneration and some risks arising from the countries in which the group operates. Fitch expects Enel Americas' management to maintain its leverage profile and conservative financial policies.

KEY RATING DRIVERS

Strong Shareholder Linkage: Fitch believes Enel Americas has a strong relationship with its majority shareholder and ultimate parent, Enel Group. This is demonstrated by the parent increasing its equity stake to 82.3% from 65%, after the completion of the merger of Enel Green Power and Enel Americas. Enel Group has a majority presence on the board of directors of Enel Americas with four employees making up a voting majority.

Fitch believes the company and its subsidiaries have extraordinary financial support through its parents financing arm, Enel Finance International N.V. (A-/Stable) to support the companies to pursue strategic acquisitions and/or seek financing for general corporate purposes.

Merger of EGP and Creation of Enel Colombia: Enel Americas' merger with Enel Green Power (EGP) and creation of Enel Colombia, a new agreement with Grupo Energia de Bogota (GEB, BBB/Stable) are positive credit events. The merger with Enel Green power added 3.9GW of renewable capacity in key markets (i.e. Brazil and Colombia). The merger expands the company's footprint into Panama (BBB-/Negative), Costa Rica (B/Negative), and Guatemala (BB-/Stable).

Fitch estimates EGP Central American businesses will contribute $400 million to consolidated EBITDA in 2022. The creation of Enel Colombia, which includes EMGESA (BBB/Negative), CODENSA (AAAcol), Enel Green Power Colombia, and the central American assets, ends the longstanding dispute between GEB and Enel Americas; Enel will maintain control at 57.345% of Enel Colombia, which is a key vehicle for growth and dividends for the consolidated group.

Exposure to Non-Investment Grade Markets: Enel Americas' 'A-' IDR is supported by the cash flow from its Peruvian business, which covers hard-currency interest coverage by 1.8x, making the applicable country ceiling that of Peru at 'A-', per Fitch's "Global Non-Financial Corporates Exceeding the Country Ceiling Rating Criteria." A majority (82%) of the company's 2021 EBITDA is estimated to come from non-investment grade markets, after Colombia's downgrade to 'BB+' from 'BBB-'.

However, Enel Americas is a key player in these markets, and Brazil and Colombia are expected to drive the company's growth over the rating horizon. Fitch estimates Enel's Brazilian operations will comprise of 37% of total EBITDA in 2021, Colombia will represent 42% and Argentina 3%. The higher concentration of sub-investment grade markets is offset by the lack of financial debt at the operating levels and conservative financial policies.

Strong Leverage Metrics: Fitch estimates Enel Americas' gross leverage, measured by total debt to EBITDA, in 2020 was 2.0x, an increase from 1.6x in 2019; the increase of leverage is due to the 27% decrease in EBITDA associated to the coronavirus pandemic, mostly explained by a decrease in demand ($480 million), bad debt collections ($90), and FX devaluation ($745 million). Nonetheless, the company's consolidated leverage remains consistent with the 'a' category per Fitch sector navigator for Latin American utilities. Fitch estimates gross leverage will be 2.0x in 2021 and will be flat at an average of 1.6x thereafter through 2024.

Strong Corporate Governance: Enel Americas has a coherent and good track record in implementing its business strategy, particularly in successfully integrating and improving efficiency of acquired entities within the group, evident through its acquisition of Celg Distribuicao S.A. and Enel Dx Sao Paulo (formerly Eletropaulo).

Enel Americas has clear and transparent financial policies, such as raising capital at the operating level in the same currency that cash flows are generated, protecting itself from any FX volatility and maintaining a conservative capital structure principally at its distribution businesses, optimizing cash flows giving itself greater financial flexibility. These policies have proven to be crucial in 2020 as the company successfully navigated a difficult economic crisis exacerbated by the coronavirus.

Sustainability Strategy: Fitch believes Enel Americas' long-term sustainability strategy and vision is a credit positive. Enel Americas' strong market position in the largest urbanized regions in South America offers a unique opportunity to grow its Enel X business segment. Enel X is a new business line that promotes energy efficiency as well as use of clean energy offering products and services such as e-city (smart lighting), e-home (billing and collection services) and e-mobility (charging stations for cars) to residential, industrial and transportation clients. Enel Americas' integrated generation and distribution segments compliment such growth.

Equity Rating: Fitch rates Enel America's shares at 'Primera Clase Nivel 1(cl)' based on its solid solvency and free float of 18.3%, according to its ownership structure. In terms of liquidity, it has 100% market presence and average daily traded volumes of approximately USD4.9 million in the last month. Enel Americas is listed in the Selective Stock Price Index (IPSA) of the Santiago Stock Exchange.

DERIVATION SUMMARY

Enel Americas' ratings are in line or above Latin American peers Enel Chile (A-/Stable) and above Engie Energia Chile S.A. (BBB+/Stable), Colbun (BBB+/Stable) and AES Andes (BBB-/Stable) as a result of the company's strong relationship to parent Enel S.p.A (A-/Stable) and its stronger financial profile while carrying a more diversified geographically and business risks.

Fitch estimates Enel Americas' consolidated gross leverage defined as total debt to EBITDA for 2021 will be 1.9x and remain at this level through 2022. This is lower than AES Andes's consolidated gross leverage over the rating horizon of 3.3x, and in line with Engie, Colbun and Enel Generacion Chile with leverage below 2.0x.

Enel Americas' business risk profile is comparable to that of Grupo Energia de Bogota (BBB/Stable), Empresa Publicas de Medellin (EPM; BB+/Rating Watch Negative) and AES Andes (BBB-/Stable). Enel Americas has a riskier geographical mix that is offset by its larger size and balanced distributed EBITDA between generation and distribution business.

Enel Americas has a superior business structure that generates more stable margins, given the company's EBITDA generation is evenly distributed between the electric generation and distribution businesses in each of the countries it operates, which contributes to a more stable cash flow generation. The company's geographic diversification provides it with greater resilience against economic cycles.

KEY ASSUMPTIONS

--EBITDA somewhat evenly distributed between Generation and Distribution business and, to a lesser extent, free market, reaching a combined total EBITDA of USD4.0 billion by 2022;

--Average annual generation production between 50,000GWh - 55,000GWh;

--Average annual distribution sales between 100,000GWh - 120,000GWh;

--Average annual capex of USD2.2 billion;

--50% of net income dividend pay-out ratio;

--Effective tax rate of 30%.

RATING SENSITIVITIES

Factors that could, individually or collectively, lead to positive rating action/upgrade:

--Although a positive rating action is not expected in the short to medium term given the company's exposure to countries with below investment-grade ratings, a positive rating action might be considered if credit metrics improve on a sustained basis with a gross debt to EBITDA consistently below 1.5x;

--An improvement in the mix of cash flow generation towards higher credit quality markets would be viewed positively

Factors that could, individually or collectively, lead to negative rating action/downgrade:

--A downgrade of Peru's country ceiling from 'A-';

--A material and sustained deterioration of credit metrics (reflected in a debt to EBITDA ratio greater than 2.5x and EBITDA to interest coverage below 5.0x.

--A change in Enel Americas' power generation business' commercial policy that results in an imbalanced long-term contractual position.

--Further acquisition by Enel Americas' increasing its exposure to non-investment-grade countries; and

--Any divestments by Enel Americas of its assets in investment-grades countries (Panama and Peru);

--The deterioration of the macroeconomic conditions and respective sovereign ratings, in the company's key markets, including Peru.

BEST/WORST CASE RATING SCENARIO

International scale credit ratings of Non-Financial Corporate issuers have a best-case rating upgrade scenario (defined as the 99th percentile of rating transitions, measured in a positive direction) of three notches over a three-year rating horizon; and a worst-case rating downgrade scenario (defined as the 99th percentile of rating transitions, measured in a negative direction) of four notches over three years. The complete span of best- and worst-case scenario credit ratings for all rating categories ranges from 'AAA' to 'D'. Best- and worst-case scenario credit ratings are based on historical performance. For more information about the methodology used to determine sector-specific best- and worst-case scenario credit ratings, visit https://www.fitchratings.com/site/re/10111579.

LIQUIDITY AND DEBT STRUCTURE

Solid Liquidity: The company's liquidity continues to be solid. At June 30, 2021, Enel Americas reported nearly USD1.5 billion of cash and equivalents, where approximately 16% is denominated in USD and the remaining portion allocated in different currencies due to the nature of its operations. The company's liquidity is further buoyed by available committed credit lines totaling USD1.4 billion. This compares favorably with short-term financial debt of USD1.4 billion for next 12 months. Fitch expects Enel Americas will either refinance bank loans and repay debt maturing in over the rated horizon to optimize its capital structure.

ISSUER PROFILE

Enel Americas and its subsidiaries generate, transport and distribute energy in Argentina, Brazil, Colombia, Peru, and Central America. Enel Americas is Latin America's largest privately-owned energy company. As of end of 1H21, Enel Americas had an installed capacity of 15.2 GW and supplies more than 25.9 million clients.

REFERENCES FOR SUBSTANTIALLY MATERIAL SOURCE CITED AS KEY DRIVER OF RATING

The principal sources of information used in the analysis are described in the Applicable Criteria.

ESG CONSIDERATIONS

Unless otherwise disclosed in this section, the highest level of ESG credit relevance is a score of '3'. This means ESG issues are credit-neutral or have only a minimal credit impact on the entity, either due to their nature or the way in which they are being managed by the entity. For more information on Fitch's ESG Relevance Scores, visit www.fitchratings.com/esg.

More information: https://www.fitchratings.com/research/corporate-finance/fitch-affirms-enel-americas-at-a-outlook-stable-05-08-2021